how much tax is taken out of my first paycheck

Multiple jobs or spouse works. Enter your personal information.

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

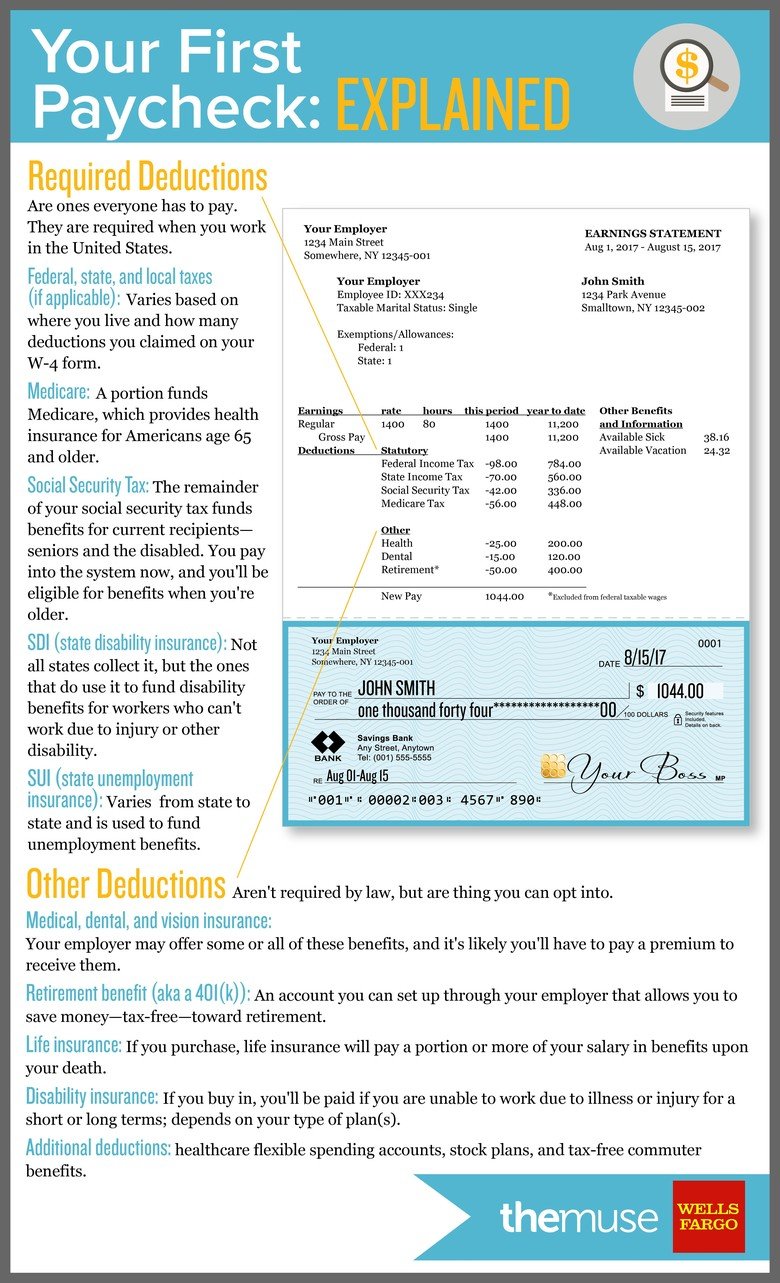

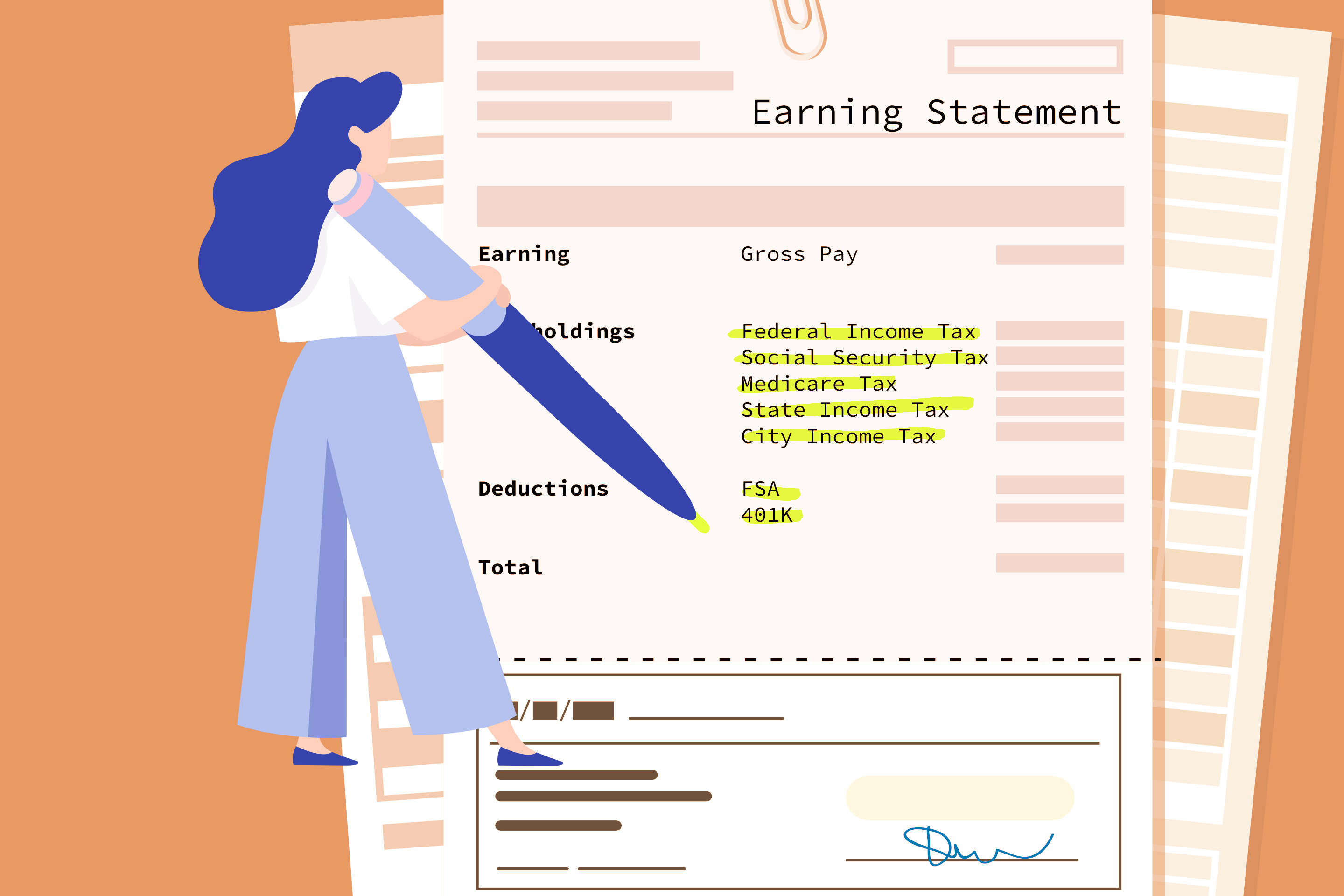

FICA stands for Federal Insurance Contributions Act and refers to the contributions to social security that are taken out of every paycheck.

/thinkstockphotos80410988-5bfc479b46e0fb0083c6dabe.jpg)

. How much tax is taken off a paycheck in Ontario. The exact percentage that is removed fluctuates. The IRS encourages everyone including those who typically receive large refunds to do a Paycheck.

505 on the first 44470 of taxable income. Estimate your federal income tax withholding. If you earn 50000 before taxes and you contribute 2000 of it to your 401 thats 2000 less youll be taxed on.

An example of how this works. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. It depends how much you make.

Thats 70 which is whats left after you deduct 30 That means in the. Any of these far-reaching changes could affect refund amounts. Some states follow the federal tax.

The irs encourages everyone including. The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. For Tax Years 2017 and 2018 the North Carolina individual income tax rate is.

To figure out what the take-home pay would be in that scenario simply multiply the salary times 070. The Social Security tax rate in the United States is currently 124. What percentage of taxes are taken out of payroll.

For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475. When you file your tax return youd. Ad Know what your tax refund will be with FreeTaxUSAs free tax return calculator.

Some deductions from your paycheck are made. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. However you only pay half of this amount or 62 out of your paycheck -- the.

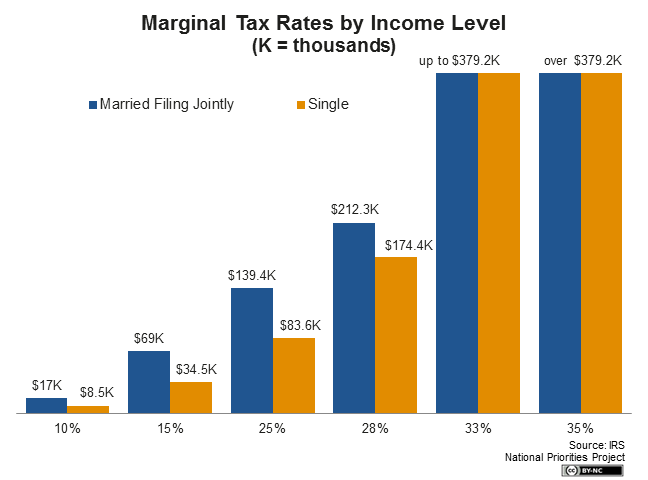

For Tax Years 2019 and 2020 the North Carolina individual income tax rate is 525 00525. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

For a single filer the first 9875 you earn is taxed at 10. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Use this tool to.

Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. The state tax year is also 12 months but it differs from state to state. Federal income taxes are paid in tiers.

915 on portion of taxable income over 44470 up -to 89482. The first step is filling out your name address and Social Security number. Discover The Answers You Need Here.

See how your refund take-home pay or tax due are affected by withholding amount. The current rate for.

Your First Paycheck Explained The Muse

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

Free Pennsylvania Payroll Calculator 202 Pa Tax Rates Onpay

Free Paycheck Calculator Hourly Salary Smartasset

Florida Paycheck Calculator Smartasset

Here S To Firsts Understanding Your First Paycheck A Security Insurance Agency

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Free Paycheck Calculator Hourly Salary Smartasset

What Are Employer Taxes And Employee Taxes Gusto

Why Does My Federal Withholding Vary Each Paycheck

5 Tricks For Getting A Bigger Paycheck In 2021 Money

Salary Paycheck Calculator Calculate Net Income Adp

Pretty Basic Stuff But My Math Teacher Took The Time To Teach Us How To Do Taxes Even Though It S Not In The Curriculum R Mildlyinteresting Mildly Interesting Know Your Meme

/check-remote-deposit-capture-at-cafe-636248010-59318df35f9b589eb47c36c1.jpg)